A Guide to How Dynamic Pricing Algorithms are Used in Financial Services

by Florida Funk

Dynamic pricing algorithms have revolutionized various industries by allowing companies to adjust prices in real-time based on market demand, supply, and other external factors. In financial services, these algorithms offer significant benefits for both business operations and client offerings. This article explores the use of dynamic pricing algorithms in financial services, focusing on Buy Now Pay Later (BNPL), B2B BNPL, and BNPL SaaS solutions.

Introduction to Dynamic Pricing in Financial Services

Dynamic pricing algorithms, driven by machine learning and advanced analytics, enable financial service providers to offer flexible payment options and adjust pricing based on real-time data. These algorithms are essential for maximizing revenue, minimizing customer churn, and maintaining competitiveness in a rapidly changing market.

Proprietary Algorithms for Flexible Payments

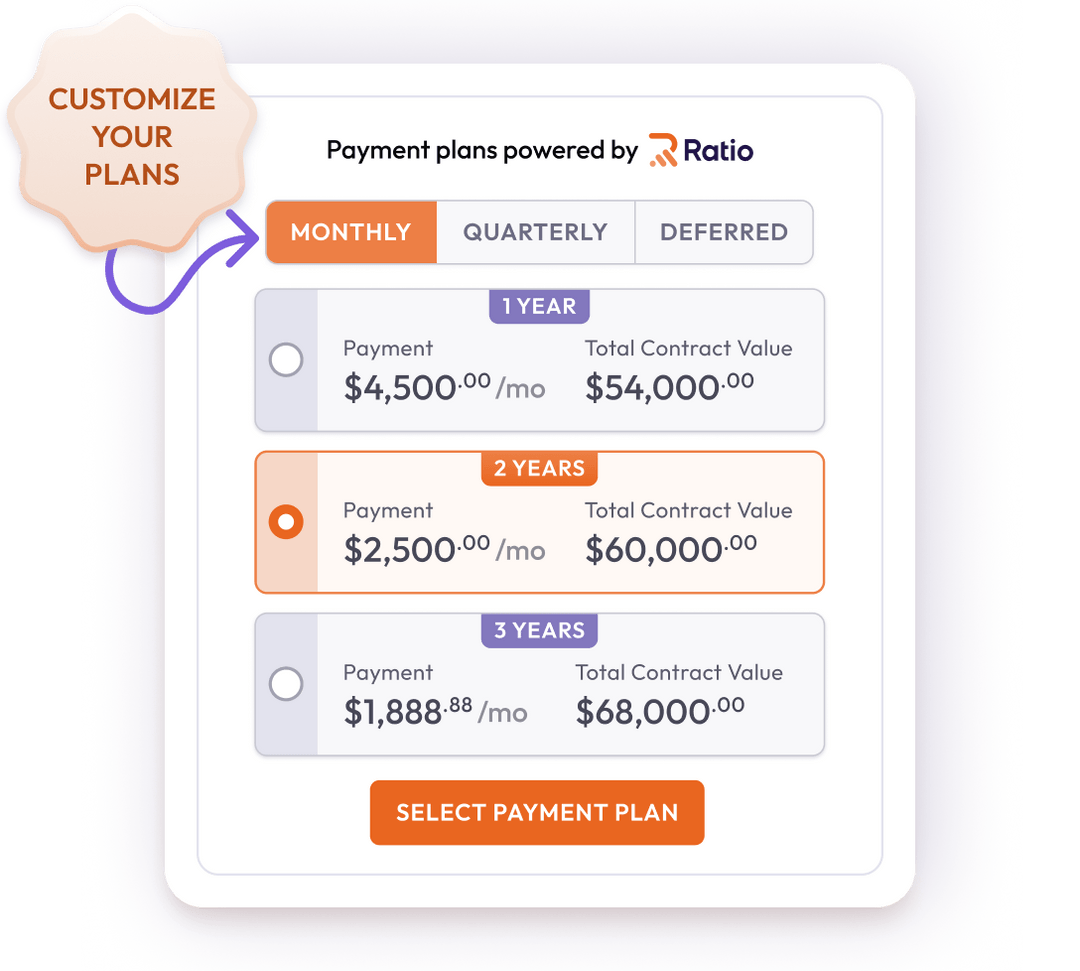

Financial services firms use proprietary algorithms to offer flexible payment plans. For instance, BNPL SaaS solutions leverage dynamic pricing to assess buyer risk and determine appropriate payment schedules without compromising speed. This approach helps increase sales volume and expand market size, particularly for small and medium-sized businesses (SMBs).

Impact on Business Operations and Client Offerings

Dynamic pricing algorithms streamline sales closing processes compared to traditional financing methods. By converting default risk and collections burdens into positive cash flow, financial services firms can reduce costs for both buyers and sellers. Additionally, these algorithms improve customer experience and maintain loyalty by offering competitive prices and attractive payment options.

Applications of Dynamic Pricing Algorithms

Dynamic pricing algorithms are widely used across various industries, including transportation (Uber), hospitality (Airbnb), retail (Amazon), and more. In financial services, these algorithms optimize pricing for products like BNPL, revenue-based financing (RBF), and subscription models.

Enhancing Sales and Market Competitiveness

Financial service providers can use dynamic pricing to compete with competitors and attract their customers. By offering variable pricing based on real-time market conditions, companies can maximize revenue and profit while aligning with business objectives.

Mitigating Risk and Enhancing Customer Experience

Risk management and actuaries can leverage dynamic pricing algorithms to develop effective mitigation strategies. These algorithms assess buyer risk and adjust pricing accordingly, ensuring that financial services firms maintain market stability and protect consumers.

Case Study: A startup trucking company using Ratio Tech's BNPL solution increased sales by approximately 30% by offering flexible payment options to smaller businesses. This approach helped them maintain financial stability and improve customer satisfaction.

Market Trends and Predictions

The global recession has led SMBs to seek new financing options, such as BNPL and RBF. Ratio Tech, with $411 million in funding, is at the forefront of this financial innovation. AI and machine learning are increasingly being used in dynamic pricing algorithms to enhance performance and optimize pricing strategies.

Importance of AI and Machine Learning

AI and machine learning play a crucial role in developing dynamic pricing algorithms. These technologies enable financial service providers to analyze vast amounts of data, identify patterns, and make real-time pricing adjustments. By continuously improving their models, companies can stay ahead of market trends and maintain a competitive edge.

Future of Dynamic Pricing in Financial Services

As financial services continue to evolve, dynamic pricing algorithms will become increasingly important. Regulators and policymakers must stay informed about these advancements to ensure market stability and consumer protection. Consultants and advisors can help financial service providers adopt these technologies and develop strategies to remain competitive.

Statistics:

-

Ratio Tech's B2B BNPL solution has helped companies increase their annual recurring revenue (ARR) by 50%.

-

Dynamic pricing algorithms have reduced customer churn rates by offering flexible payment options.

Conclusion

Dynamic pricing algorithms are transforming the financial services industry by offering flexible payment options, optimizing pricing strategies, and improving customer experience. By leveraging these algorithms, financial service providers can maximize revenue, reduce costs, and stay competitive in a rapidly changing market.

As dynamic pricing continues to evolve, financial service professionals, data scientists, risk managers, fintech enthusiasts, regulators, and consultants must stay informed about these advancements. By embracing these technologies, they can drive innovation, improve financial stability, and enhance client offerings.

In summary, dynamic pricing algorithms are a powerful tool for financial services, offering numerous benefits and opportunities for growth. By understanding and applying these algorithms, companies can navigate the complexities of the market and achieve long-term success.

Dynamic pricing algorithms have revolutionized various industries by allowing companies to adjust prices in real-time based on market demand, supply, and other external factors. In financial services, these algorithms offer significant benefits for both business operations and client offerings. This article explores the use of dynamic pricing algorithms in financial services, focusing on Buy Now…

Recent Posts

- New England Home Buyers Expands Services to Natick, North Andover, Saugus, and Tewksbury, MA: Fast and Stress-Free Home Sales

- Dos Reyes PGH: Pittsburgh’s Premier Food Truck Gearing Up for Upcoming Events

- AmRide Expands Services to Include Comprehensive Driver for Hire and Event Transportation Solutions

- Sound UP Marketing: Revolutionizing Long Island Web Design and SEO Services

- Long Island HVAC Hero: The Premier Choice for HVAC Services and Furnace Repair on Long Island